MUSCAT: The MSX30 Index ended the week down by 0.76%. All sub-indices closed down, led by the Financial Index, which ended the week lower by 2.12%, the Services Index by 2.09%, and the Industrial index that closed down by 0.89%. The MSX Shariah Index closed also down by 1.26%. GCC, Arabs and foreigners absorbed the selling pressure from Omani investors, with a net buy of USD 1.3mn worth of securities during the week.

During the week, Oman Fisheries Company announced that it got a clarification from the Capital Market Authority (CMA) over the accounting treatment that is connected to the Sale of Al Ameen Cold Store in the Consolidated Financial Statements of the company’s second quarter. Oman Fisheries Company (Parent company) published its financial results as of the 30th of June of the year 2022. These results showed a profit from the proceeds of the sale of Al Ameen of RO 2.6. The difference in the profit was accounted for in the 2nd quarter through shareholders equity instead of the profit & loss.

Bank Nizwa announced the signing of a financing agreement to develop the RO 250mn Al Nakheel Integrated Tourism Complex (ITC) Project. Bank Nizwa signed the agreement with Palm Beach LLC for Al Nakheel Project that will be developed by Alargan Towell Investment Company. Al Nakheel Project is an Integrated Tourism Complex under the auspices of the Ministry of Heritage and Tourism. With a total value of RO 250mn, the mixed-use community real-estate development is idyllically located on the seafront between Al Seeb and Barka, in close proximity to the Daymaniyat Islands Nature Reserve. Slated to be constructed on a land area of 500,000 sqm, Al Nakheel Project will have a total built-up area of 369,000 sqm, envisaged to be developed in three phases.

Leading Omani engineering and construction services contractor Galfar said that it is keenly eyeing opportunities linked to the implementation of new projects worth an estimated RO 2 billion due to come on the market over the next three years. Galfar is also working actively to diversify its business model to include, for the first time, projects procured under the Public Private Partnership (PPP), Design Build Own Operate Maintain (DBOOM) and Engineering Procurement Construction (EPC) models. Having emerged from a transformation exercise that has spawned in a leaner, streamlined and focused contracting company, Galfar has sets its sights on achieving a minimum turnover of RO 200 million annually.

The Central Bank of Oman (CBO) and Omantel signed a Memorandum of Understanding (MoU) on September 13 to introduce an accelerator programme to nurture and empower fintech startups. The MoU was signed by the CBO Executive Director Tahir bin Salim al Amri and Omantel CEO Talal bin Said al Maamari. The signing of the MoU comes within the framework of the Omani FinTech Roadmap launched by the Central Bank to promote fintech in the Sultanate of Oman and support fintech startups, SMEs, banks and technology companies. The partnership combines the expertise and shared vision of the Central Bank of Oman and Omantel to support local fintech startups.

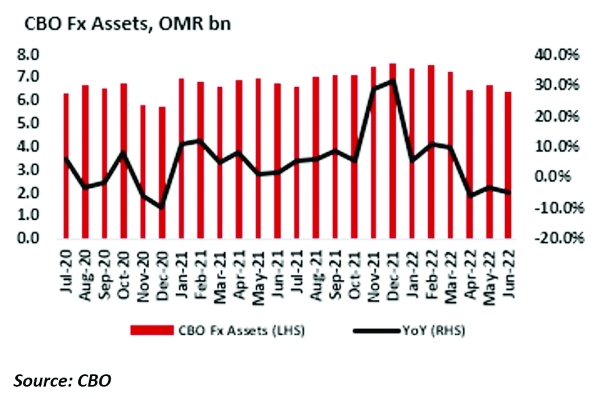

CBO’s foreign assets stood at RO 6.393bn as at the end of Jun’22, having decreased by 5.1% YoY and 4.7% MoM or RO 312mn during the month. The MoM decrease is brought about by a 16.1%MoM decline in placements abroad (which account for 41% of the total foreign assets), a 1.6%MoM decrease in IMF Reserve Assets (6.7% of total), despite a 6.6%MoM increase recorded in securities held and while bullion was flat. CBO’s foreign assets are notably above the trailing 12-month simple average of RO 7.0bn. These assets include bullion, IMF reserve assets, placements abroad and foreign securities.

Muscat Stock Exchange (MSX) has commenced efforts to secure a much-coveted elevation into the ranks of ‘Emerging Market’ stock exchanges. Haitham bin Salem al Salmi, CEO of Muscat Stock Exchange, who is also Chairman of Muscat Clearing & Depository, said the ‘upgrade’ is a key component of the five-year strategy mapped out by the Omani bourse as part of its goal to go partially private in five years via a listing on the MSX. [Courtesy: U-Capital]