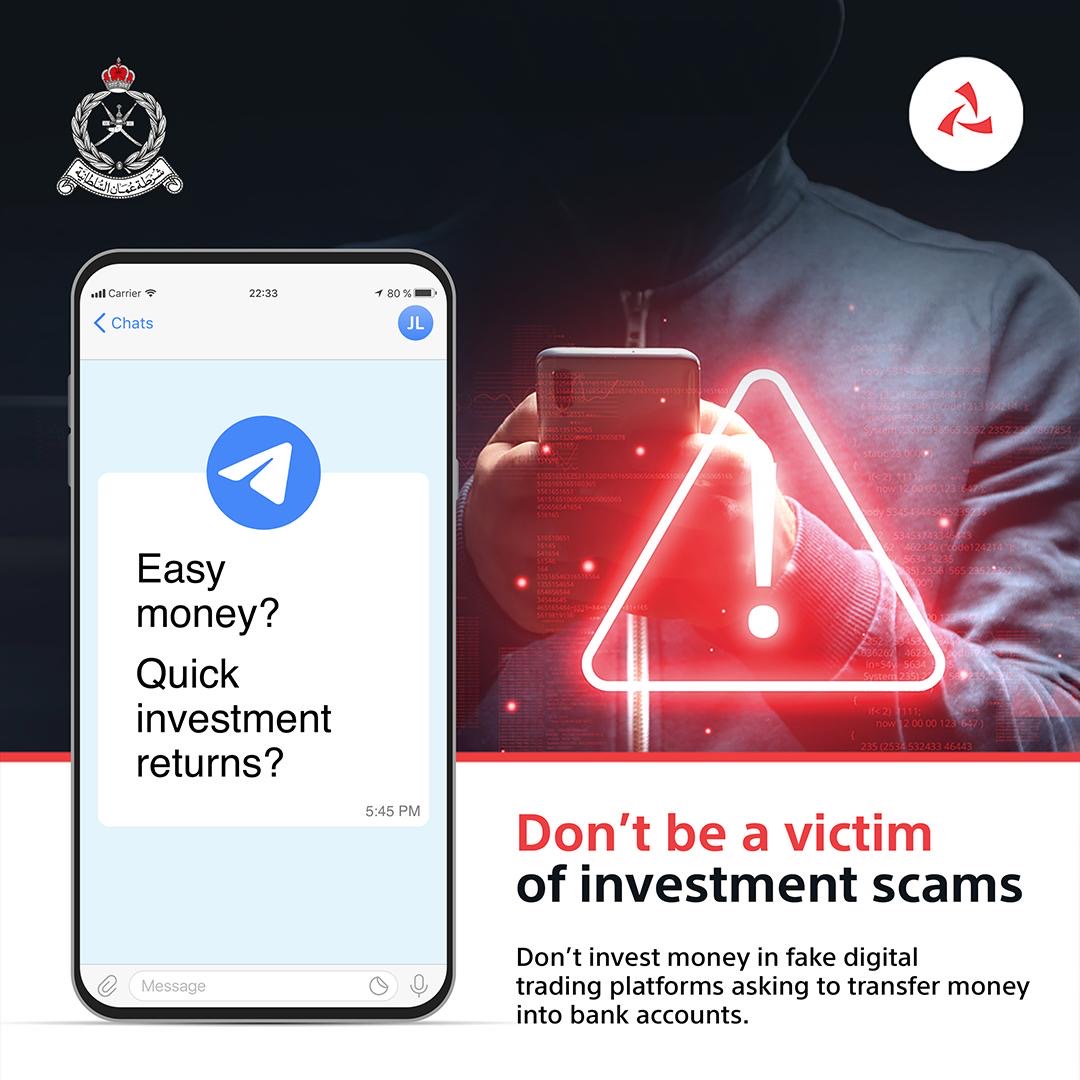

In an ongoing effort to increase public awareness of various methods of digital fraud, Royal Oman Police and Bank Muscat recently emphasised the serious consequences of digital trading platform scams as part of their joint anti-fraud initiative. Fake investment scams are on the rise and it is crucial to recognise them in order to protect oneself.

To avoid falling victim to fraudulent scams, there are a number of precautious steps that need to be taken: avoid responding to messages with doubtful investment offers; be wary of attractive returns in digital currency and other investments; avoid sharing details such as your password, OTP including PIN and CVV, and digital wallet information; research the investment company and the offer thoroughly; and most importantly, block and report the sender if found suspicious.

The awareness initiative will continue throughout the year across various media channels including TV, radio, print, online media, and social media; aiming to help the public recognise fraud and avoid falling prey to misleading messages on WhatsApp, requests to share bank details with others, … etc.

It is essential to never share personal details with anyone, including those claiming to be employees or officials in certain institutions as this is a vital first step to defend oneself against criminal activities. Being wary and vigilance against fraud methods will help reduce the financial and psychological consequences that they cause.

The public can easily contact the Royal Oman Police hotline at 80077444 to report fraud or for any fraud-related queries.